|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

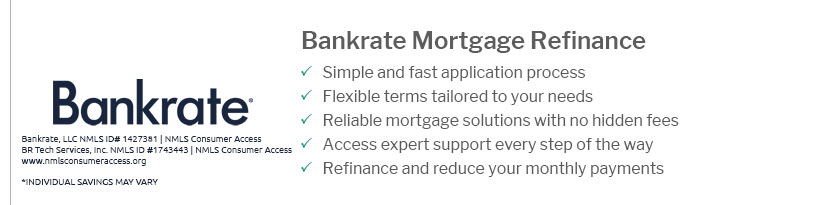

Understanding USA Mortgage Refinance Options and StrategiesRefinancing a mortgage in the USA is a financial strategy that homeowners often consider for various reasons. Whether you're looking to lower your monthly payments, adjust your interest rate, or tap into home equity, understanding the nuances of mortgage refinancing is crucial. In this article, we explore key aspects of mortgage refinance to help you make an informed decision. Reasons to Consider Mortgage RefinancingRefinancing your mortgage can be beneficial under the right circumstances. Below are some common reasons homeowners opt for refinancing:

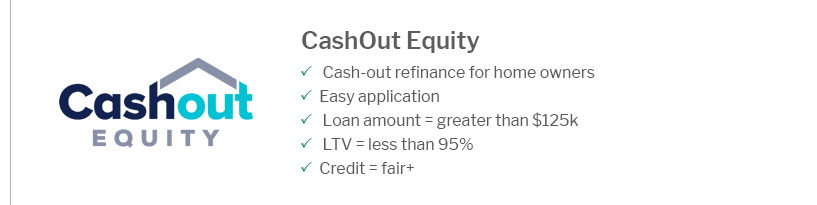

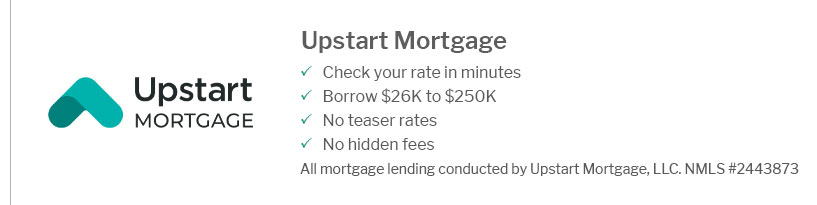

Types of Mortgage RefinanceUnderstanding the different types of refinancing options available can help tailor a solution to your financial goals. Rate-and-Term RefinanceThis is the most common type of refinancing. It involves changing the interest rate, loan term, or both, without altering the principal balance. This option is often pursued when us mortgage rates are lower than when the original mortgage was obtained. Cash-Out RefinanceA cash-out refinance allows homeowners to convert home equity into cash by taking out a new mortgage larger than the existing one. This is beneficial for those needing funds for large expenses or investments. Cash-In RefinanceWith a cash-in refinance, the homeowner pays down a significant portion of the mortgage to reduce the loan-to-value ratio, potentially qualifying for better rates or terms. Steps to Refinance Your Mortgage

For veterans considering refinancing, exploring options like a va mortgage loan can offer unique benefits tailored to their needs. Frequently Asked Questions

https://www.usamortgage.com/the-ultimate-guide-to-refinancing-a-home/

It means you're getting a new loan to replace your current mortgage, one that will have lower monthly payments, lower interest rates, allow you to pay off your ... https://www.usamortgage.com/when-to-refinance/

When interest rates fall (as they have post-COVID), many homeowners choose to refinance their existing loan for a new loan offering a significantly shorter term ... https://www.usamortgage.com/todays-rates/

Loan Assessment Progress. The Home of Possibility. Get Started With Your Rate Quote! Home Purchase Home Refinance. Great! What is the property type? Single ...

|

|---|